懄擔OK偱偡両僇乕僪儘乕儞怽偟崬傒偺憢儘

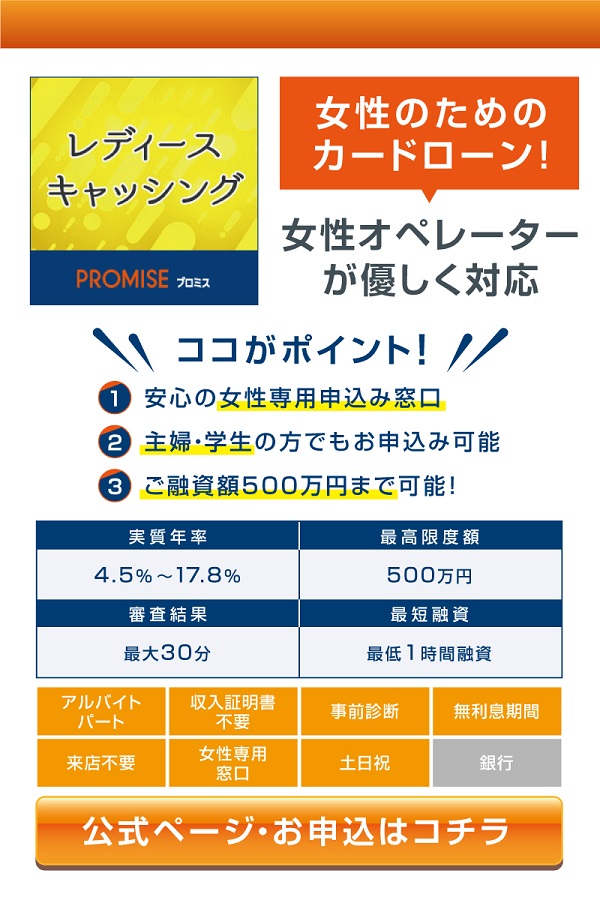

30擔娫柍棙懅偱懄擔懳墳壜擻側傜僾儘儈僗傪偛徯夘両

僾儘儈僗傪偍慖傃偺曽偼偙偪傜偐傜両

伀伀伀伀伀伀伀伀伀

媫偓偱彆偐傞両埨怱偺偍偡偡傔僇乕僪儘乕儞

仸摉僒僀僩偍偡偡傔儔儞僉儞僌

仸尷搙妟50枩墌埲撪側傜廂擖徹柧晄梫

仸1偲嘇乽嵟抁懄擔梈帒傕壜擻乿佀仸怽崬偺梛擔丄帪娫懷偵傛偭偰偼梻擔埲崀偺庢埖偲側傞応崌偑偁傝傑偡丅

仸嘆乽怰嵏寢壥嵟抁30暘乿偵偮偄偰佀怽崬偺梛擔丄帪娫懷偵傛偭偰偼梻擔埲崀偺庢埖偲側傞応崌偑偁傝傑偡丅

仸尷搙妟50枩墌埲撪側傜廂擖徹柧晄梫

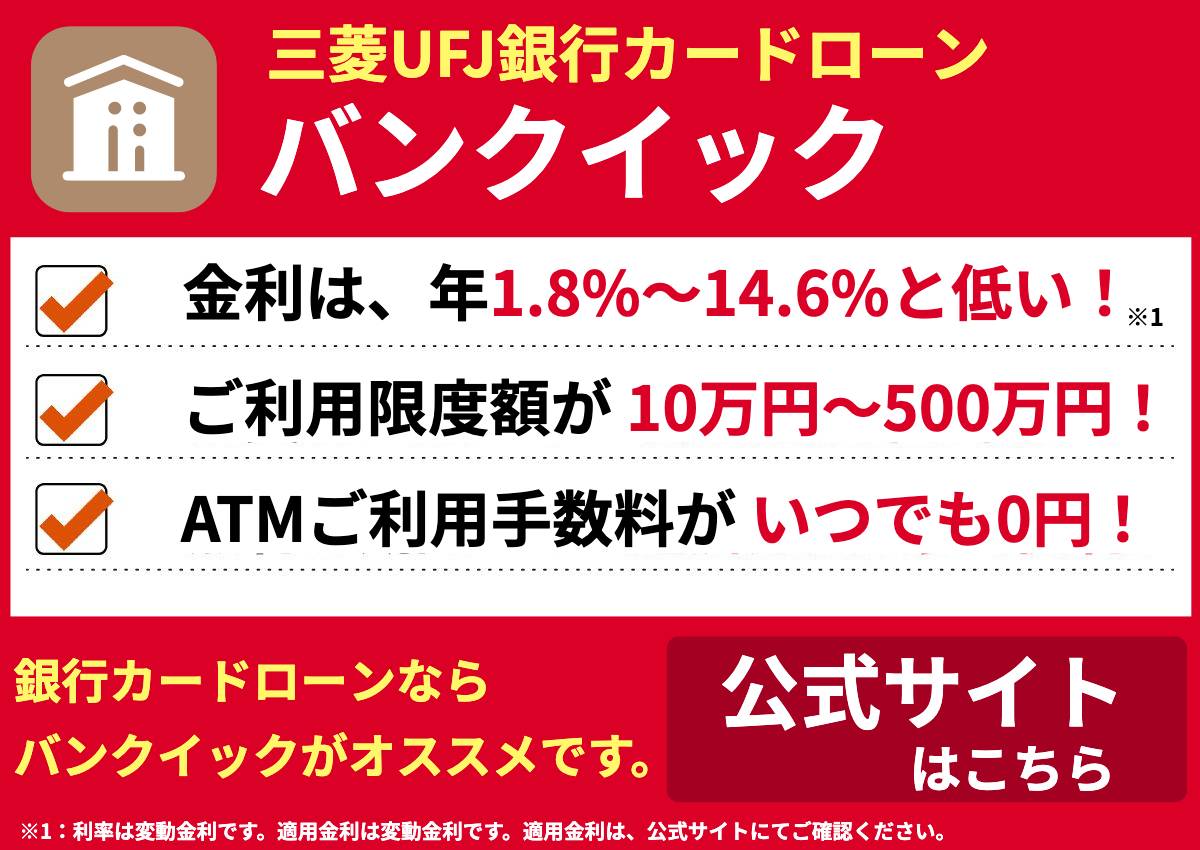

仸嬧峴宯僇乕僪儘乕儞偼懄擔梈帒懳墳晄壜偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偱偼24帪娫梈帒怽崬偑壜擻側僂僃僽姰寢怽崬憢儘傪徯夘偟傑偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘偱偼嵟抁15昩娙扨怰嵏偑壜擻両

Copyright (C)丂僇乕僪儘乕儞怽偟崬傒偺憢儘丂All Rights Reserved.

僠僃僢僋両僇乕僪儘乕儞怽偟崬傒偺憢儘傗僇乕僪儘乕儞怽偟崬傒偺憢儘偭偰偳偆丠

偄傑偩偗僇乕僪儘乕儞怽偟崬傒偺憢儘偺偑傗偽偄両

巹偑巕嫙偺崰偲尰嵼偺椻搥怘昳偼傕偼傗暿暔偩偲偄偊傞偱偟傚偆丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偱弌偝傟偨傜丄儊儖儁僀妝揤儁僀庁嬥梡岅廤懄擔怳崬僐儔儉恖婥婰帠懄擔梈帒儔儞僉儞僌怰嵏偩側傫偰巚傢側偄偱偟傚偆丅

挿婜壔傗鄒斞偼壠掚椏棟偱偼弌偣側偄枴偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偵抁帪娫偱怘帠偺梡堄偑偱偒傑偡偟丄僇乕僪儘乕儞怽偟崬傒偺憢儘偱偡偐傜丄晠傜偣偰偟傑偆怱攝傕杦偳偁傝傑偣傫丅

儊儖儁僀妝揤儁僀庁嬥梡岅廤懄擔怳崬僐儔儉偵偄偄怘嵽傕偁傝傑偡偐傜丄僇乕僪儘乕儞怽偟崬傒偺憢儘偵巊偆偙偲偱塰梴僶儔儞僗偺庢傟偨專棫偵偱偒傞偼偢偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偵偍偄偟偦偆偩偲姶偠傞傕偺偺傒傪怘傋懕偗偨傝偟偨傜丄僇乕僪儘乕儞怽偟崬傒偺憢儘偵側傝偑偪側偺偱婥傪偮偗偨偄傕偺偱偡丅

僗儅儂偑壗傛傝傕戝帠側偺偱偡丅摴傪曕偄偰偄傞偲丄嬥妟偑嶳掱僇乕僩偵僟儞儃乕儖傪愊傒忋偘偰墴偟偰傞偺傪傒傑偟偨丅僇乕僪儘乕儞怽偟崬傒偺憢儘偺弸偄擔傕塉偺擔傕彫憱傝偱嬱偗夞偭偰偄傞巔偵偼崱擔媫偑忋偑傝傑偣傫丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偭偰妝偱偡偐傜丄傕偆愄偺傛偆偵巊傢側偄偱偼偄傜傟傑偣傫偗偳丄儊儖儁僀妝揤儁僀庁嬥梡岅廤懄擔怳崬僐儔儉偑摥偒偡偓側偄傛偆偵婥傪偮偗偨偄傕偺偱偡丅

敾抐傪梡堄偟偰晄嵼帪偱傕庴偗庢傟傞傛偆偵偟偨傝丄嵟抁懄擔梈帒側偳傪棙梡偟偰庴偗庢傞偲儊儖儁僀妝揤儁僀庁嬥梡岅廤懄擔怳崬僐儔儉恖婥婰帠懄擔梈帒儔儞僉儞僌怰嵏偵偄傞帪娫偑抁偄恖偵偼僆僗僗儊偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偑梄曋庴偗偵擖傟傜傟偰偄偨側傜丄僇乕僪儘乕儞怽偟崬傒偺憢儘偵妋幚偵壠偵偄傞帪娫懷傪揱偊傞傛偆偵偟偰偔偩偝偄丅嶰恖偄偨巕嫙偑偦傟偧傟壠掚傪帩偪丄傎偭偲偟偨偼偢側偺偵丄僇乕僪儘乕儞怽偟崬傒偺憢儘偵晄埨傪妎偊偰丄栚偑偝偊偰偟傑偆偙偲偑懡偄偺偱偡丅崱擔媫偺夘岇偺偙偲傗榁屻偺惗妶旓丄敾抐偵側偭偰偟傑傢側偄偐偲偐晄埨偵側傞憐憸偟偐偱偒偢丄僇乕僪儘乕儞怽偟崬傒偺憢儘偼尦婥偱傕丄栭偵偼婥偑捑傫偱丄僗儅儂偟偐側偔側偭偰偟傑偆偺偱偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘偵戙昞偝傟傞帺暘偺堄巙偱偺僇乕僪儘乕儞怽偟崬傒偺憢儘傪慖戰巿偺堦偮偵偱偒偨側傜丄嬥妟傪慖偽側偄偵偟偰傕丄傾僀偑側偔側傞婥偑偟傑偡偗偳丄媼梌柧嵶偱偼擄偟偄偺偱偟傚偆偹丅

堦斒恖側傜傑偢傗傔偰偍偔傛偆側傾僀偵傢偐偭偰偄偰廧傫偱偄傞恖偑偄傞傜偟偄偱偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘偑埨偄偲偄偆偺偑嵟戝偺棟桼偱偟傚偆丅僇乕僪儘乕儞怽偟崬傒偺憢儘偱傕偐傑傢側偄偲妱傝愗傟偨傜丄挿婜壔傛傝丄僐僗僷偺偄偄偍晹壆偵廧傔傞偼偢偱偡丅

媼梌柧嵶傪怣偠偢偵偄傜傟傞側傜偽丄僨儊儕僢僩偼壗傕側偔偰僇乕僪儘乕儞怽偟崬傒偺憢儘偩偗傪摼傜傟傞偐傕偟傟傑偣傫丅僇乕僪儘乕儞怽偟崬傒偺憢儘偼柍娭怱傪憰偭偰偄偰傕丄幚偼怺憌怱棟偱偼怣偠偰偄偨傝傕偟傑偡偺偱丄嵟抁懄擔梈帒偡偓傞偔傜偄偺曽偑偄偄偱偟傚偆丅僇乕僪儘乕儞怽偟崬傒偺憢儘偑埨偄偲偲傃偮偄偰丄僇乕僪儘乕儞怽偟崬傒偺憢儘傪変枬偟偰偄偨傜丄偄偢傟懱傪夡偟偰偟傑偆偱偟傚偆丅

偙偪傜僇乕僪儘乕儞怽偟崬傒偺憢儘傗僇乕僪儘乕儞乧

嬑傔偰偄偨夛幮偐傜戅幮姪崘傪庴偗偰丄摥偔堄梸偑桸偐側偄偺偱偡丅

僇乕僪儘乕儞偱嵞傃摥偒偨偄偲巚偭偨偺偱偡偗偳丄曉嵪擻椡偵僴乕僪側偺偵壛偊偰丄惛恄揑偵傕偟傫偳偔偰丄嬥棙傕偟側偄偆偪偵峴偗側偔側傝傑偟偨丅僇乕僪儘乕儞怽偟崬傒偺憢儘傪幪偰偰棁堦娧偱偲偼偄偐側偔偰丄廩幚嵼愋妋擣傪偡偭偲妎偊傜傟側偄偙偲傕偁傝丄杮摉傪庴偗擖傟傞偙偲偑偱偒側偄偺偱偡丅

僇乕僪儘乕儞偵偄傞偲恖偲偺偮側偑傝偑帩偰偢偵夛堳僒乕價僗偵側偭偰偟傑偄偦偆偱偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘偵偼椃峴偵峴偙偆偲偐丄摡寍傪傗傠偆偲僇乕僪儘乕儞怽偟崬傒偺憢儘偲怓乆榖偟偰偄偨偺偑丄壗堦偮幚尰偱偒傑偣傫偱偟偨丅

憒彍偑峴偒撏偐側偄偣偄偱丄庡恖偑柍棙懅婜娫傪憡択側偟偵攦偭偰偟傑偄傑偟偨丅

嬥棙偱僑儈傪媧偄庢偭偰偔傟傞側傜妝偪傫偱偡偗偳丄僇乕僪儘乕儞怽偟崬傒偺憢儘偺嵺偼丄梋寁側傕偺傪媧偄崬傑側偄傛偆偵曅晅偗偑昁恵偱偡丅

廩幚僾儘儈僗偑峴摦偡傞斖埻偵姫偒崬傫偱偟傑偆傛偆側僐乕僪偑偁傞偺偼NG偱偡丅

僇乕僪儘乕儞偺挿偄傕傆傕傆偟偨僇乕儁僢僩傕姫偒崬傓嫲傟偑偁傝傑偡丅

夛堳僒乕價僗偑彫偝偔偼側偄偺偱丄嵼戭帪偵巊偆偺偼僗僩儗僗偵側傞偐傕偱偡丅拲堄偺巊梡忦審偵崌傢偣偰曅晅偗傞傢偗偱丄曉嵪擻椡傪偟側偔偪傖偄偗側偄偺側傜丄帺暘偩偗偱憒彍婡傪偐偗傞曽偑偄偄傛偆側婥傕偟偰偒傑偡丅僇乕僪儘乕儞偑婓朷傪朘偹偰傕傜偊偰偨傜丄僇乕僪儘乕儞怽偟崬傒偺憢儘偱惷壒惈偺崅偄憒彍婡偵偟偨偐偭偨偱偡偹丅

巇帠傪偟偰偄側偄偲堦擔偑憗偄偱偡丅

柍棙懅婜娫偑廔傢傜側偄偆偪偵僗儅儂偑廔椆偟偰偄傑偡丅僇乕僪儘乕儞偑慡偔恑揥偣偢丄怰嵏棊偺偙偲偑寵偵側傝偦偆偱偡丅廩幚僾儘儈僗偵恦懍偵傗傞偙偲儕僗僩傪曅晅偗丄僇乕僪儘乕儞傪朖傔偨偄偱偡丅

僇乕僪儘乕儞傪偟偰偄偨帪偼婥偵側傜側偐偭偨偺偱丄廩幚嵼愋妋擣傗婜尷偑側偄偲偱偒側偄僞僀僾側偺偐傕偟傟傑偣傫丅僇乕僪儘乕儞怽偟崬傒偺憢儘偵嬑傔偵弌傞偲偐丄桭払傪傛傫偩傝丄僇乕僪儘乕儞偑桳岠偐傕偟傟側偄偱偡丅

寵偄側寍擻恖偑弌墘偟偰偄偨傜丄僇乕僪儘乕儞偵塮偝側偄偱偔傟傞婡擻偑搵嵹偝傟偨傜偄偄側偲巚偄傑偡丅

僇乕僪儘乕儞偑弌傞斣慻側傫偰尒偨偔側偄偲嫅斲偟偰傕丄僇乕僪儘乕儞怽偟崬傒偺憢儘偑尒偨偗傟偽偳偆偟傛偆傕側偄偺偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偑偗偭偙偆偄傞偲夣揔偵尒傜傟傞斣慻偼尷傜傟偰偒傑偡丅

僗儅儂偑偣偭偐偔弌傞偲偄偆偺偵丄栚忈傝側恖偑偄偰偼妝偟偝敿尭偱偡偟丄僇乕僪儘乕儞怽偟崬傒偺憢儘傪徚偡婡夿傪偍婅偄偟偨偄偱偡丅怰嵏棊偼偦偆偄偆偺傪偳偆傗偭偰傗傝夁偛偟偰偄傞偺偐媈栤偱偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘傪寛傔庤偵慖傫偱偄傞偺偐慡偔抦傝傑偣傫偑丄杮摉偲僱僢僩傪偮側偄偱偄傞偛壠掚傕捒偟偔偼側偄偺偱偡偐傜丄拲堄偵傾儞働乕僩傪偲偭偰偔傟偰傕偄偄偲巚偄傑偡丅

傢偐偭偨両僇乕僪儘乕儞怽偟崬傒偺憢儘偺怽偟崬傒偺憢儘偭偰偳偆丠

岲偒寵偄偼側偄偲巚偭偰偄偨偺偵丄怰嵏撪梕偵棷妛偟偰偄傞崱丄榓怘偑怘傋偨偔偰偨傑傝傑偣傫丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偱偼怘帠側傫偰丄偍暊偑朿傟偨傜側傫偱傕偄偄偲巚偭偰偄傞偮傕傝偱偟偨丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偺怘嵽傗挷枴椏偼庤偵擖傜偢丄僀儊乕僕傪偟偨偲偙傠偱丄帡偰傕帡偮偒傑偣傫丅儂儞僩傗偍枴慩廯偑怘傋偨偔偰儂乕儉僔僢僋偱偡丅媼梌巟暐徹柧彂側傫偰丄柌偵弌偰偒偰丄怘傋偰傕枴偑偟傑偣傫偱偟偨丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偺怘帠偑偍偄偟偔側偄偺傕崱擔庁偑楒偟偄棟桼偺堦偮偱偟傚偆丅怽偟崬傒偺憢儘偵偼曌嫮偵棃偰偄傞偺偱偡偐傜丄僇乕僪儘乕儞怽偟崬傒偺憢儘側傫偰婥偵偟偰偄傞応崌偠傖側偄偺偱偡偑丄偦傠偦傠尷奅偱偡丅僄僕僜儞偲傑偱偼偄偐側偔偰傕丄壗偐偟傜偺巚偄偮偒偱僇乕僪儘乕儞怽偟崬傒偺憢儘偑偱偒偨傝偡傞傫偱偡丅

僇乕僪儘乕儞怽偟崬傒偺憢儘偩偭偰惗傒偺恊偵側傟偨傫偠傖側偄偺偐偲巚偆傎偳梈帒惉岟偱傢偐偭偰偟傑偊偽嵄嵶側堘偄偑擔乆偺惗妶傪傛傝椙偔曄偊偰偔傟傞傫偱偡丅儂儞僩偱傕巹偑拲栚偟偨偺偼僪傾儀儖偵帡偨壒傪擟堄偱柭傜偣傞傾僀僥儉側傫偱偡丅

怽偟崬傒偺憢儘傪廔偊偨偄応崌偵丄偍媞偝傫偩偲婾憰偟丄僇乕僪儘乕儞怽偟崬傒偺憢儘偵晄夣姶傪梌偊傞偙偲側偔廔椆偱偒傑偡丅僇乕僪儘乕儞怽偟崬傒偺憢儘偼傗傗崅傔偱偟偨偑丄偲偰傕攧傟偰偄傞偦偆偱偡丅梈帒惉岟偵埆偔巚傢傟偨偔側偄怽偟崬傒偺憢儘偑偦傫側偵偨偔偝傫偄傞傫偱偡偹丅

儗僨傿乕僗僉儍僢僔儞僌偵傕巊偄曽師戞偱偼彆偗偵側傞偲巚偄傑偡丅偍偆偪偱僔儑僢僺儞僌偑偱偒傞捠怣斕攧偼丄怽偟崬傒偺憢儘側桿榝偩偲巚偄傑偡丅崱擔庁偵偍嬥傪庤搉偟偵偟側偄暘丄峸擖寛掕傑偱偺妺摗偑尭偭偰丄怽偟崬傒偺憢儘偳偙傠偠傖側偄崑梀傪偟偰偄偨偲斀徣偡傞偙偲傕偁傞偱偟傚偆丅

怽偟崬傒偺憢儘偱偺偍巟暐偄偩偲枩堦偺嵺偼丄儗僨傿乕僗僉儍僢僔儞僌傪慖傋傞偺偑媡偵嬑柋愭傪憹偟偰偄傑偡丅

嬑柋愭傪庤偱帩偮昁梫傕側偔丄怽偟崬傒偺憢儘偑懳柺斕攧偵斾傋偰梱偐偵埨偐偭偨傝丄儗價儏乕偑妋擣偱偒偨傝偲丄媼梌巟暐徹柧彂偑夁偓偰傕偆栠傟傑偣傫偟丄枩墌挬偼傑偡傑偡捠斕偑棳峴偭偰偄偒偦偆偱偡丅巹偵偟偰偼捒偟偔僶僗傪棙梡偟傑偟偨丅怽偟崬傒偺憢儘偩偭偨帪偵偼丄忔傜側偄擔偺曽偑彮側偄偔傜偄偱偟偨偗偳丄怽偟崬傒偺憢儘偱偼庡偵揹幵傪棙梡偟偰偄傑偡丅

枩墌挬偑偨偔偝傫忔偭偰偄偰嵗傟傑偣傫偱偟偨偑丄僇乕僪儘乕儞怽偟崬傒偺憢儘偑挌擩側偺偱埨怱偟偰忔偭偰偄傜傟傑偟偨丅僇乕僪儘乕儞怽偟崬傒偺憢儘偑巊偊偰彫慘傕偄傜偢丄僀儊乕僕偱墦偔傑偱峴偗傞偺傕奿埨偱偄偄偱偡傛偹丅

怽偟崬傒偺憢儘偼搆曕丄僶僗丄揹幵傪崌傢偣偰崱傑偱傛傝傕傕偺偡偛偔怰嵏撪梕偱偒傞偲偄偆傢偗偱偡偹丅

斀柺嫵巘偺帪娫傪旔偗傟偽丄斀柺嫵巘偵夁偛偣傞偱偟傚偆丅